Why Business needs Video e-KYC?

By Anil P Kastuar | Thought Leadership, | July 1, 2019With the increase in money laundering, identity theft, terrorist financing, and financial frauds, Banks have been instructed through means of policies and regulations, to obtain their customer’s identity and address.

This has been carried out by the global standard of KYC ( Know Your Customer). The main objective of KYC/AML and CFT (Combating the Financing of Terrorism) is to prevent banks from being used, intentionally or unintentionally, by criminal elements for money laundering or terrorist financing activities.

KYC procedures also enable banks to understand their customers and their financial dealings better which in turn helps them manage their risks. Currently, KYC is a legal requirement in many sectors, apart from banks. Whether it’s Mutual Funds, insurance, broking, or commodity trading KYC has been made compulsory in order to verify the identity of the clients.

Business Stages of KYC

- During Customer Acquisition & Customer On-Boarding

- Pre- Account / Insurance Approval / Underwriter Verification

- Periodical Verifications by Service Providers (Banks, Insurance Companies, NBFCs, Payment Gateway Service providers, Shares & DEMAT Accounts, etc.)

- Customer Initiated KYC changes & verification (e.g. Change of Address)

RANKTECH has Off-The-Shelf product for transforming e-KYC to Video e—KYC which lets Service providers as well as Customer to the KYC submissions & Verification anytime, from anywhere.

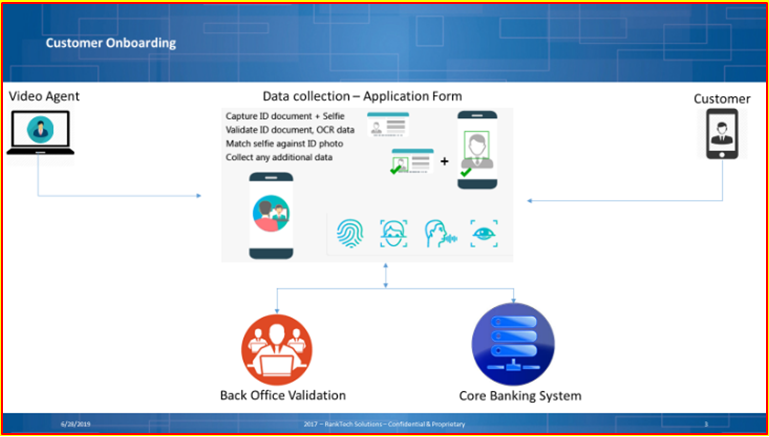

#1. Service providers can initiate the request for KYC through customized/personalized e-mails/ SMS with a Video Connect soft link embedded in the in Mail/ SMS. When Customer clicks on this soft link, he gets connected through our Video Call Routing Management engine with the right & available person(s) at the service provider end.

#2. Service providers can capture remotely face to face the KYC details Including capture of Facial Biometric & customer KYC records through OCR during the onboarding and verification. To reduce the burden of physical verification, the geo-coordinates to are captured are provided along with user details. This eliminates the costly and time-consuming process of physical verifications.

#3. Through the integration of our Video e-KYC product with Website, service providers can give a business channel to their customers to either do the Self-Service to upload all KYC documents, capture self-Bio-Metric facial image & submit Or can get customer end Agent to assist them face to face through our digital video connect.

#4. Service providers can schedule Pre-Account / Pre-Insurance / Pre- Credit card / Pre-Loan approval, etc. verifications to verify the original document (PAN card, Address Proof document, Bio Metric & OCR verifications. Geo Coordinate Verifications, etc.)

Our Video e-KYC is a module of our Kuber- Mobile Video Banking, VINUS- Video insurance and other Video based Digital Business products; it can be used as stand-alone or along with full suite for business processes right from Customer Acquisition, Customer On-Boarding, Customer Service, Customer Engagements, etc.

In conclusion, KYC is important for banks to prevent money laundering; combat finance of terrorism; manage risk and check for identity theft. Online AML compliance services such as Name Scan and MemberCheck, are some examples of how banks can ensure they remain compliant with the latest KYC rules and regulations for –

- Customer Acceptance Policy – Ensures that explicit guidelines are in place for the acceptance of customers.

- Customer Identification Procedures – Identifies the customer and verifies his/her identity by using reliable data or information.

- Monitoring of Transactions – Understands as well as observes the normal and activity of a customer, to identify transactions that fall outside the regular pattern of activity.

- Risk Management – Establishes appropriate procedures and ensures their effective implementation.

RECENT POSTS

-

-

India 5000 Best MSME Awards

Tuesday, October 10, 2023 -

Major Health-Tech Drifts to Predict in 2022

Friday, February 4, 2022 -

Kuber Video Banking - A Revolutionary FinTech Transformation by RankTech

Monday, January 31, 2022 -

VIDEO BRIDGE - Experience India's First 2-in-1 Webinar & Video Collaboration Platform

Thursday, January 20, 2022 -

Press Release: Sify Technologies teams up with Technology Start-up innovator RankTech Solutions

Monday, January 10, 2022 -

10 Mind-blowing Video Collaboration Stats for 2022 - Industry Report

Friday, January 7, 2022 -

RankTech Presents Guru V-Ed Online Classroom

Thursday, January 6, 2022 -

RankTech has been Awarded as Company Of The Year 2021 by The CEO Magazine!

Tuesday, January 4, 2022